I will preface this post by stating that, if my writing style doesn’t totally give it away instantly, I do not claim to be an economist.

I will also state that I’m working from the collective recognition and assumption that the middle class is shrinking and/or disappearing; that is, the rich are getting richer and the poor are getting poorer.

I will also recognize the discomfort that surrounds talking about money and finances. Growing up, the adults in my life whispered tensley about finances behind closed doors. They pinched pennies, they bought generic everything. As kids, we learned early not to ask for money or extras. We recognized getting a modest allowance was something for which we should be thankful.

So with that inherent discomfort in my own upbringing, and knowing how heated it can become to talk about money and values and expectations and shortcomings …

I am going to talk about it anyway.

This post is not a guilt trip or sad puppy eyes or a “go fund me” plea. It’s an effort to explore, process, and recognize that being modestly middle class is truly out of reach for many of us.

And there’s an awful lot to unload and so many rabbit trails to wind down, so this will certainly not be a comprehensive or exhaustive pondering of how the middle class eludes us.

After leaving “the nest”, everyone has a series of reality checks. When they start living independently as adults, the learning curve can be steep and unforgiving. Jobs must be taken on, bills must be paid, cars must be fixed, trips might be canceled as expenses pop up. We learn how expensive life is!

There’s a lot of abstracts to learn: prioritizing, sacrificing, waiting, risking, managing expectations, creativity, hustling.

But I also grew up thinking that with an education, with or without a partner, with effort and work – at a certain time, I’d be able to find financial stability and comfort. I’d make ends meet, and have a little leftover to give away and/or enjoy. I’d be able to travel modestly, seeing places throughout our country and maybe even throughout the world. I’d be able to save toward bigger goals, like investing or owning a home.

I know what’s comfortable and suitable varies hugely from one person to another. And yet, many of those same people would define themselves in similar terms – as middle class, “comfortable.”

So what constitutes middle class?

Hint: it’s not what it used to be.

In the previous generation, the middle class was benchmarked by: home ownership, owning a car for each adult, being able to afford college for your 2.5 kids, having retirement security and savings, healthcare that covers your needs, and alas, the illustrious annual vacation. There isn’t an official dollar amount attached to qualify for the middle class, as family size and where the family lives (and surely countless other variables) must be considered, but Pew Research suggests it falls between $40,500 – $122,000. The NY Times suggested it ranges from $48,000 to $145,000 for a family of (ahem) 3.

Quite hard to pinpoint, eh?

Today, the list looks a little more cynical. I misplaced the link (grr!), but I spent time earlier today pouring over a list of 30 or so modern day middle-class qualifiers. “Highlights” included huge amounts of educational debt, necessary second jobs and permanent side hustles, health insurance you can’t afford to use, and the inability to own a home. If you do, it isn’t until much later in life. If you have kids, saving for their future college is not a given. In fact, having savings at all is not a given. “Vacations” are often a visit home to the parents, sleeping in your childhood bedroom.

Hey, at least you moved out though, right?

This is a middle class?!

This article – again, my apologies for losing the link – drive home that much has changed and that middle-class aspirations are not easy to climb up to.

Financial comfort is not easy to come by.

Clawing your way out of poor/working class/lower-middle class isn’t a matter of skipping an overpriced latte or buying generic meds, as some out-of- touch Boomers might suggest. (I am sorry to peg the Boomers with that complaint, but there’s a mentality that is hard to escape. ) When your wages are at a certain level, there is no money TO save. When your wages are at a certain level, owning a home (an investment that you cannot afford to take care of) DOESN’T make more sense than renting.

We make sacrifices and sometimes, it all works out okay. But at other times, poverty charges interest in very concrete ways.

I have a very blessed life. I’ve let go of many of the financial trappings that I once assumed would make me a legitimate adult. I seek security and comfort in my relationships, in my faith. We may not have savings, but we never go hungry. We may not own our home, but we live in a safe, clean (enough 😉) home in a neighborhood we treasure. We may not have name brand shoes and clothes, but no one here is naked or in rags. We may have “more month than money” at times, but we also have a wonderful and generous support system. We may not have great health insurance, but we have insurance and despite it’s limitations, good doctors. We may not have annual vacations, but we do have working cars and the ability to put fuel in them.

We truly are very blessed.

It wouldn’t be enough for everyone, but it’s usually enough for us.

Usually.

Some of the things that keep our family unit “down” – or middle class aspirationals? Educational loans. A larger-than-average family. Working in service professions and non-profit settings. One income instead of 2. The prohibitive cost of and of availability of childcare. Putting emergencies, and sometimes essentials, on credit. The cost of healthcare bills after insurance has “negotiated.” Many of these factors are woven together, interconnected.

We ask for help when we need to, and we strive to help others when we can.

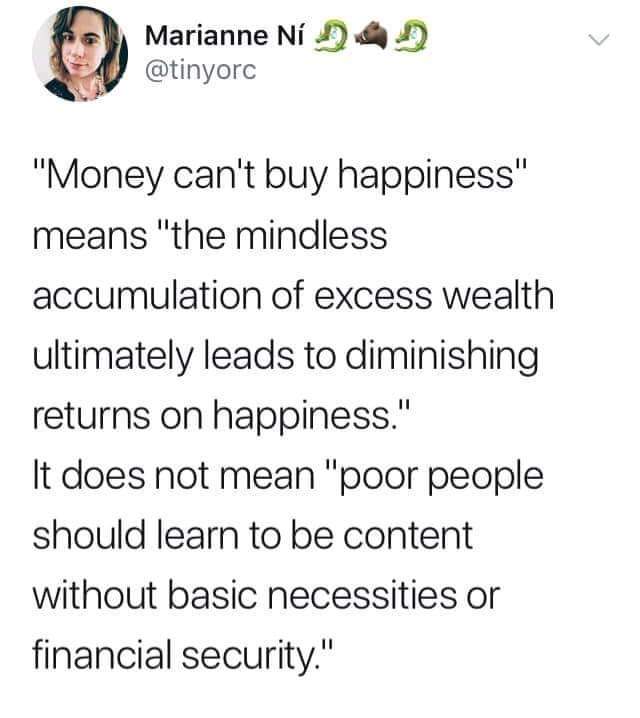

But I think it’s important to realize our middle-class aspirations can’t be solved by simply pinching pennies and clipping coupons. There is hard work, yes, but there are also systems that keep people down.

I’m not offering any simplistic or radical solutions: cancelation of debt, universal basic income, and so on. Like I said, I’m not an economist. But it feels like something needs to change – more and more struggle. The disappearing middle class isn’t disappearing because of a bunch of lazy people.

Wherever we’re classified, we know what’s important to us. I’d be lying if I said we don’t hope to find ways to “get ahead” and to maybe have months where we can save something or plan a hubby-wife getaway. We certainly dream of it. I’d be fibbing if I said the anxiety of waiting on money to pay bills doesn’t take a toll. I’d be disingenuous to say I don’t like confronting my own ugly jealousy when I see peers, via social media, living it up on vacations.

Money is complicated. Values are complicated. People are complicated.

People and how they align their values with their finances can be complicated.

It can all be uncomfortable to navigate, but it’s important to remember we don’t navigate these financial issues alone.

I love your message, Laura. I work with people all the time (a volunteer job) where I know their struggles which have now been magnified because of COVID. Some do find a way out of poverty but most struggle every month to pay bills. What makes a difference in this part of Maryland is all of the food pantries, agencies with the mandate to help financially, churches and HHS which is dedicated to reaching out in multiple ways. When I see pictures of other parts of our country where cars line up for hours to pick up boxes of food, I realize that equality is missing across this land. Of course we know that the rich are getting richer (even in the midst of this pandemic) and the poor are struggling even more. I really wish Congress would get their act together to help right now.

LikeLike